Reference Chart – LRI

February 17, 2014 at 1:15 pm 2 comments

Previously we talked about LRI being in our watchlist.

til then we mentioned consolidation as part of a nice reversal for LRI. So far, LRI is having a nice breather. Question then is, when’s the right time to pick one?

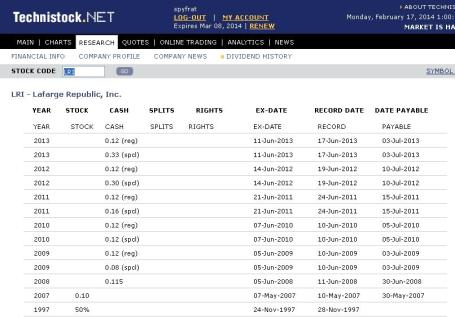

notice how LRI’s cash div is increasing each year. If we use the previous total cash div of 0.45/share, this coming June 2014 (base on its historical declaration), at 9.00-peso per share, that’s 5% yield.

So: Is LRI a buy or not

So What: If i add the div yield of 5%, that will be a Yes.

So What Now: by simple math, if LRI stays in the doldrums, 8.55 a piece is the level where my risk start til June (9 x 0.95 = 8.55, if we count the eggs right away).

So What Now Nga: If i got the dough (which can sit til end of May to early June, then ill do it), otherwise, being handicapped in funds limit a small investor to do what he or she pleases.

So What Now Nga e: kakasabi ko lang. isa pa, kurutin ko na pwet mo. #cornynessfoundhere

Entry filed under: Phisix's Closet (PSEi).

2 Comments Add your own

Leave a comment

Trackback this post | Subscribe to the comments via RSS Feed

1. Julius H. Baltazar | February 17, 2014 at 2:53 pm

Julius H. Baltazar | February 17, 2014 at 2:53 pm

Thank you for posting the LRI chart Sir.

2. spyfrat | February 17, 2014 at 4:45 pm

spyfrat | February 17, 2014 at 4:45 pm

anytime boss. ngat n God bless